Five Simple Money Skills You Need To Know

Money may not buy happiness, but it does buy options. Options let people choose what makes them most happy. As such, acquiring and managing your money is a necessary skill in order to relieve such worries, such as being able to afford food, gas, and even healthcare. The following are five basic money skills that you need to know. You will have more options before you know it!

1. Go For That Promotion By Being Likable

Have you ever heard the expression, “It’s not what you know. It’s who you know”? It’s very much reality because often it doesn’t matter if you’re the best at your job. It matters more that your coworkers and bosses like your personality. Being someone likable leads to more promotions (and yes—options) at work!

Fighting the urge to go off by yourself during breaks and lunch hours can make sure that your coworkers can get to know you. Listening to every idea for a work project can let everyone around you feel appreciated. And when your boss gives you suggestions, actively incorporate them into your work. Respecting your team will more likely lead to that promotion that you desperately need!

2. Pay Your Debts With What Money You Can

For small financial issues, the best car title loans from Southwest Title Loans are a great solution. For someone who is drowning in debt, it is imperative that you come up with a plan on how to pay your necessary bills. Some people can afford to pay off the largest debts first. However, if you are not in that position, you may consider paying the minimum amount required for each bill every month. Making sure that your debts aren’t piling up is necessary to save money.

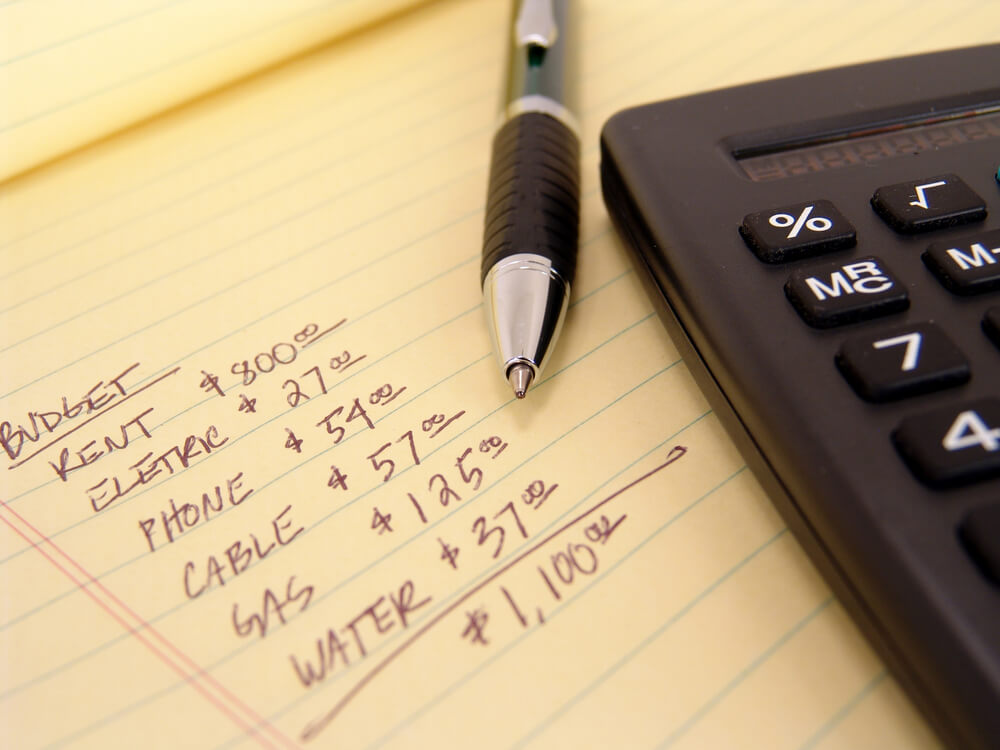

3. Budget Your Money Month By Month

To avoid situations in which you find yourself in debt, you must learn how to budget your money. When you just need a little boost for the month, title loans for cars are a great option, but you still need to know how to manage what cash you receive. Some prefer the spreadsheet method in which you meticulously go through everything that you will need to spend in a month. For those of us who are looking for something simple, try turning all of the cash that you will spend in the month into paper money. Having what you allow yourself to spend with you, can let you avoid using your credit card an unnecessary amount.

4. Read The Agreements On Credit Cards You Apply For

Southwest Title Loans has loan representatives that you can ask any questions you have about title loans. The credit card companies, however, try to sneak entire documents of jargon for you to sign right under your nose. Make sure that before you sign up for a credit card, you know your APR (annual percentage rate), annual fee and whether you have a grace period or not. Knowing what you're getting into will save you a lot of money by not signing up for the wrong credit card.

5. Learn How To Cook

It might sound weird, but I’m serious. You can save a ton of money by learning how to cook for yourself, your family, and your friends. Eating out costs a lot of money. If you follow the advice from before and know how to budget correctly, you can save money on your groceries AND acquire a great life skill. Save money and look cool at the same time!

Cash Leading To Peace Of Mind

Money skills add so much to your peace of mind, because you are in control. Knowing how to budget, cook, and pay your bills, will allow you to maintain financial stability. Now the only question is, what are you going do with all this cash?Note: The content provided in this article is only for informational purposes, and you should contact your financial advisor about your specific financial situation.